Debt settlement is usually pursued by those who are drastically powering on their unsecured debts, can no more afford minimal payments, and are considering bankruptcy as an alternative.

This facts could include one-way links or references to third-bash assets or written content. We do not endorse the third-party or assurance the precision of the third-bash data. There may be other assets that also provide your requirements.

Explore more personalized mortgage resourcesPre-qualify for a personal loanCompare major lendersPersonal loan reviewsPersonal bank loan calculatorHow to qualifyHow to consolidate bank card debtAverage own bank loan desire fees

Payment processing companiesPayroll & HR softwareE-commerce softwareMarketing softwareBusiness insuranceBusiness lawful

It’s not out with the kindness in their hearts. If somebody documents for personal bankruptcy, the lender might not get any of their a refund. Hence, it’s actually during the lender’s best desire being versatile and Allow a person pay less than the entire volume owed.

You'll have to request a manager. Clarify your economic hardship and suggest a settlement figure, Doing work towards a middle ground. Finalize the settlement: Before you decide to come up with a payment, get settlement terms in composing. You also want the creditor to document how they're going to report the settlement on the credit studies. Lorraine Roberte Creator Expert Insights:

Debt settlement organizations earn a living within the assist they provide, typically by charging expenses in the shape of the proportion of your respective latest debt or of your savings they negotiate for you. The variety is normally among 15%-25%, and it debt resettlement may be bigger.

Respected debt reduction providers have the encounter and know-how when working with creditors on debt settlements. Even so, they’ll Have you ever end payments in case you’d Beforehand been maintaining with them And so the settlement company has one thing to negotiate with. As an alternative, they’ll direct you to put These payments into a special escrow account.

Usually, debt settlement firms ask you to halt shelling out your creditors and place dollars into a selected price savings or escrow account. Once you've saved up sufficient, the business will commence making contact with creditors to barter.

– their legal professionals. Plus more. The bottom line: You could potentially wind up farther in debt than you were being once you started off your debt settlement prepare.

Even now Consider debt settlement is The solution? There's a chance you're correct, of course. For those who’re convinced, there are numerous recommendations to remember as you progress forward. The main stage is always to identify A few debt settlement providers you may trust with your online business.

Is debt settlement a good idea? The main purchase of business enterprise in producing that decision is coming to grips with how dire your economic circumstance definitely is and what other options address it.

Get started producing deposits: You will typically end paying your creditors and start generating payments into a dedicated personal savings account determined by the program you organized With all the settlement corporation.

Debt settlement providers work almost solely with unsecured debt, like bank card charges and private pupil loans. Debts backed with collateral, like home loans or car financial loans, are certainly not suitable for settlement. Dealing with your lender to refinance your automobile loan may be a possibility, having said that.

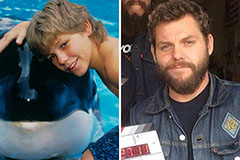

Jason J. Richter Then & Now!

Jason J. Richter Then & Now! Joseph Mazzello Then & Now!

Joseph Mazzello Then & Now! Brandy Then & Now!

Brandy Then & Now! Atticus Shaffer Then & Now!

Atticus Shaffer Then & Now! Peter Billingsley Then & Now!

Peter Billingsley Then & Now!